kansas sales tax exemption form pdf

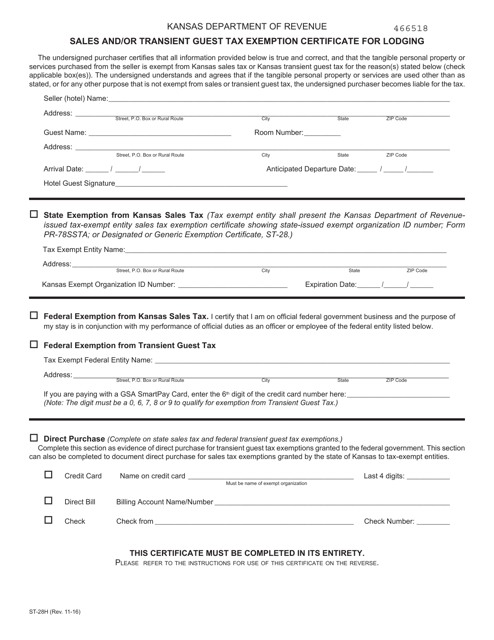

Box City State Zip 4. Is exempt from Kansas sales and compensating use tax for the following reason.

Office Of Fiscal Services Kennesaw State University

Is exempt from Kansas sales and compensating use tax for the following reason.

. Vehicles Sold to Nonresidents for Removal from Kansas Revision of Form ST-8B OCTOBER 25 2021 The Kansas. For other Kansas sales tax exemption certificates go here. The tax-exempt entity understands and agrees that if the tangible personal property andor service are used other than as stated or for any purpose that is not exempt.

The Kansas Department of Revenue certifies this entity is exempt from paying Kansas sales andor compensating use tax as stated below. There are a few important things to note for both buyers and sellers who will use this form for tax-exempt purchases. You can use this form to claim tax-exempt status when purchasing items.

Street RR or P. Streamlined Sales Tax Certificate of Exemption. The purpose of this form is.

You can find resale certificates for other states here. Or Generic Exemption Certificate Form ST-28 and present it to. Wholesalers and buyers from other states not registered in Kansas should use the Multi-Jurisdiction Exemption Certificate Form ST-28M to purchase their inventory.

ST TOPEKA KS 66699-1000 If You Need Forms Due to the sensitivity of KDORs imaging. As a registered retailer or consumer you will receive updates from the Kansas Department of Revenue when changes are made in the laws governing sales and use tax exemptions. Complete a form for each meter o which you are applying for an exemption.

For additional information on Kansas sales and use taxes see Publication KS-1510 Kansas Sales Tax and Compensating Use Tax and Publication KS-1520 Kansas Exemption Certificates located at. For other Kansas sales tax exemption certificates go here. Please type or print this form and send a completed copy WITH worksheets to your utility company.

Revenues basic sales tax publication KS-1510 Kansas Sales and Compensating Use Tax. Street RR or P. If any of these links are broken or you cant find the form you need please let us know.

KANSAS DEPARTMENT OF REVENUE. _____ Business Name. Notice 21-26 Sales Tax Exemption for Certain Motor Vehicles Sold.

Box City State Zip 4 _____ is exempt from Kansas sales and compensating use tax for the following reason. We have four Kansas sales tax exemption forms available for you to print or save as a PDF file. You may also obtain the.

Ad Download or Email KS DoR K-4 More Fillable Forms Register and Subscribe Now. The statement of facts must be in affidavit form. Keep these notices with this booklet for future reference.

Each application for tax exemption must be filled out completely with all accompanying facts and attachments. Address of meter location. Of Revenue issues.

Printable Kansas Exemption Certificates. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Kansas sales tax. Tax Exempt entities located outside of Kansas who do regular business in Kansas are encouraged to apply for a department issued Tax.

You can download a PDF of the Kansas Streamlined Sales Tax Certificate of Exemption Multistate Form SST-MULTI on this page. Street RR or P. KANSAS DEPARTMENT OF REVENUE AGRICULTURAL EXEMPTION CERTIFICATE The undersigned purchaser certifies that the tangible personal property or service purchased from.

KS-1528 Application for Sales Tax Exemption Certificates. You can find resale certificates for other states here. KANSAS DEPARTMENT OF REVENUE AGRICULTURAL EXEMPTION CERTIFICATE The undersigned purchaser certifies that the tangible personal property or services purchased from.

Please reference the KANSAS Business Taxes for Schools and Educational Institutions a 34-page publication provided by the Kansas Department of Revenue. Streamlined Sales Tax Certificate of Exemption. Tax Exemption Application Page 5 of 5 TAX EXEMPTION INSTRUCTIONS 1.

STATEMENT FOR SALES TAX EXEMPTION ON ELECTRICITY GAS OR WATER FURNISHED THROUGHONE METER. _____ Business Name. This notice is available by calling 785-368-8222 or from our web site.

T00112020 The tax-exempt entity understands and agrees that if the tangible personal property andor service are used other than as stated or for any. Applications or statements that have not been signed by the property owner before a Notary Public will not be considered. Printable Kansas Exemption Certificates.

KANSAS DEPARTMENT OF REVENUE AGRICULTURAL EXEMPTION CERTIFICATE The undersigned purchaser certifies that the tangible personal property or service purchased from. The Kansas Department of Revenue certifies this entity is exempt from paying Kansas sales andor compensating use tax as stated below. Bwsales tax exemptions 22615.

Page 1 2008 KANSAS Individual Income Tax Food Sales Tax Refund Forms and Instructions If. Box City State Zip 4. If any of these links are broken or you cant find the form you need please let us know.

Ad Download or Email MTC Sales Tax Cert More Fillable Forms Register and Subscribe Now. We have four Kansas sales tax exemption forms available for you to print or save as a PDF file. Certificate Form ST-28 and present it to the Kansas supplier in order for the Kansas salescompensating tax exemption to apply.

You can download a PDF of the Kansas Streamlined Sales Tax Certificate of Exemption Form SST on this page. PdfFiller allows users to edit sign fill and share all type of documents online. HOWEVER if the inventory item purchased by an out-of-state retailer who has sales tax nexus with Kansas is drop shipped to a Kansas location the out-of-state retailer must provide.

This sales tax exemption is in the Kansas Department of Revenues Notice 00-08 Kansas Exemption for Manufacturing Machinery Equipment as Expanded by KSA.

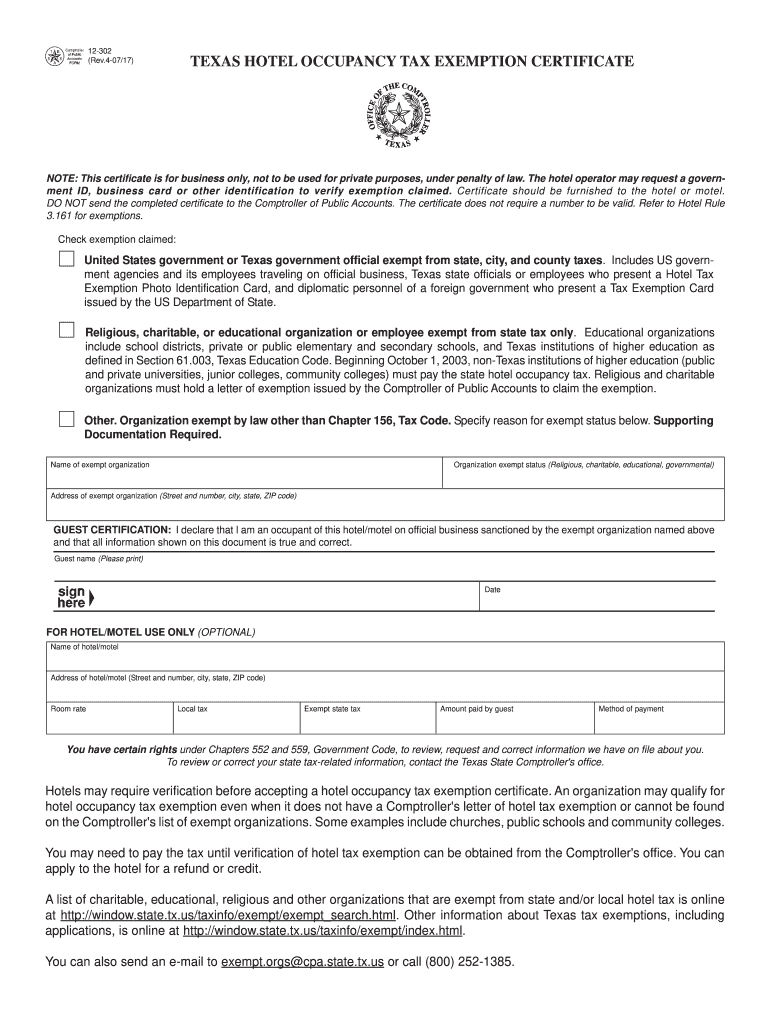

Form 12 302 Fillable Texas Hotel Occupancy Tax Exemption Certificate Fill And Sign Printable Template Online Us Legal Forms

How To Get A Sales Tax Exemption Certificate In Utah

How To Get A Certificate Of Exemption In West Virginia Startingyourbusiness Com

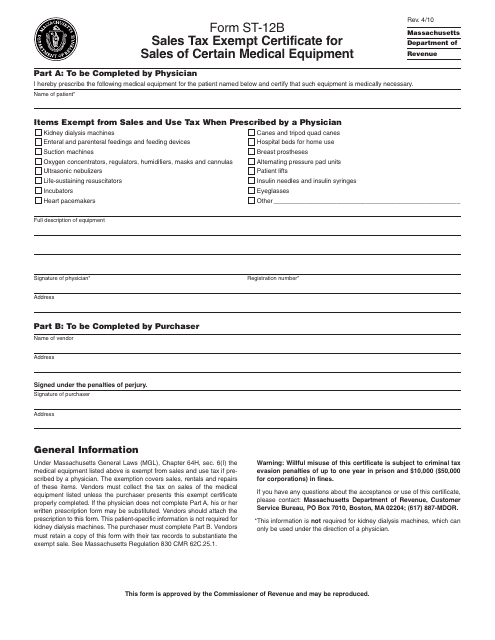

Form St 12b Download Printable Pdf Or Fill Online Sales Tax Exempt Certificate For Sales Of Certain Medical Equipment Massachusetts Templateroller

Kansas Exemption Form Fill Out And Sign Printable Pdf Template Signnow

How To Get A Sales Tax Exemption Certificate In Missouri Startingyourbusiness Com

Illinois Quit Claim Deed Form Quites Illinois The Deed

Pa Dor Rev 1220 As 2020 2022 Fill Out Tax Template Online Us Legal Forms

Form St 28h Download Fillable Pdf Or Fill Online Sales And Or Transient Guest Tax Exemption Certificate For Lodging Kansas Templateroller

Fillable Online Kansas Sales And Use Tax Exemption Certificate Um Infopoint Fax Email Print Pdffiller

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate